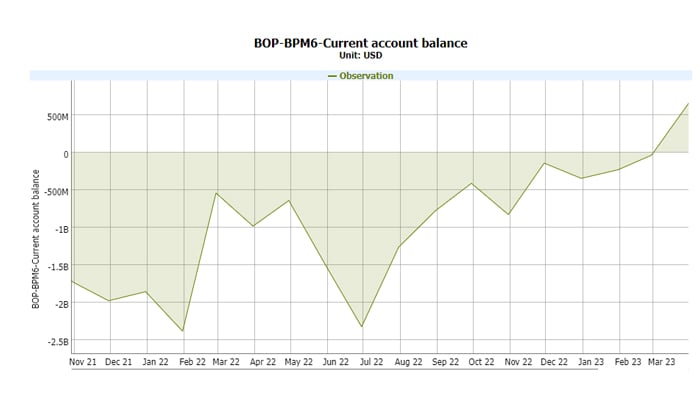

Pakistan’s current account posted a surplus in March after a 28-month period, the State Bank of Pakistan (SBP) data showed Wednesday.

It was the first time since November 2020 that the current account was in the surplus territory. This month’s surplus — $654 million — is the highest such figure since February 2015.

Last month, the current account deficit — the gap between the country’s expenditures and income — had clocked in at $74 million. It was recorded at $981 million in March 2022.

Overall, in the nine months of the current fiscal year, the current account deficit was recorded at $3.4 billion, down 74.1% from July-March 2022.

However, measures taken to reduce the deficit, including restricting imports, have dampened the pace of growth, former finance adviser Dr Khaqan Najeeb commented.

While terming the surplus a “significant” development, he noted that it had happened because of an increase in remittances due to Ramadan, which came in at $2.5 billion, and continued restrictions on imports.

“The strangulation of the imports (down 21% in March year-on-year) to manage the current account deficit has carried on for more than expected as a short-term measure. This has cost the economy in terms of growth falling to near zero and rising unemployment,” Dr Najeeb noted.

Speaking to TheNews.com.pk, Pakistan-Kuwait Investment Company’s Head of Research Samiullah Tariq said the decline in imports had outweighed lower exports and remittances.

The latest SBP data showed that imports of goods fell 34.7% year-on-year in March, clocking in at $4bn. On the other hand, exports of goods also fell 21% to $2.4bn.

Separately, remittances also declined 10.7% YoY to $2.5bn in March.

As the country’s foreign exchange reserves fell to critically low levels last year, the government decided to restrict imports to “essential items”. While some of the restrictions have since been eased, companies across all sectors have complained that banks are not opening letters of credit (LCs). Several manufacturers, especially in the automotive sector, have temporarily shut down plants citing inventory shortages.

Meanwhile, international institutions — the International Monetary Fund (IMF), World Bank and Asian Development Bank — have slashed Pakistan’s growth forecasts, projecting that the economy would grow between 0.4% to 0.6% this fiscal year.

Dr Najeeb further said that going forward, the government needs to finalise an agreement with the IMF that would lead to the disbursement of over $1 billion that the country desperately needs to stave off the risk of default. The IMF deal would also unlock fresh inflows from other international lending agencies.

The former adviser also said the government needs to find a way out of the dollar liquidity crunch.

The central bank’s reserves stand at $4 billion as of April 7, which is not enough to cover even a month’s imports.