CRISIL is one of the leading rating agencies in India. (File)

The credit rating given to Lehman Brothers, six days before its collapse in 2008, was “A” by Standard & Poor’s rating agency. The rest is history.

But did you know that the Lehman Brothers was in trouble during even the Great Depression of 1929?

The firm declared bankruptcy in 1933, and its failure had a ripple effect throughout the financial industry. Many other companies also collapsed, leading to widespread unemployment, bank failures, and economic hardships.

The collapse of Lehman Brothers and other firms in the 1930s led to the creation of new regulations and safeguards in the US. There were designed to prevent similar failures in the future, such as the Securities Act of 1933 and the creation of the Securities and Exchange Commission (SEC).

These new rules were necessary, especially in the context of the business model of these firms. Let me tell you how rating agencies work with a story…

Once upon a time, there was a rating agency called AAA Ratings. It was known for its high-quality credit assessments.

Companies and governments from around the world would come to AAA Ratings to get their credit worthiness evaluated. AAA Ratings was trusted by investors and borrowers alike. Its ratings were seen as a mark of excellence in the financial world.

However, over time, AAA Ratings began to prioritize profits over quality. The agency started to cut corners, relying more on automated models and less on human analysts to evaluate creditworthiness.

It also became more lenient in its assessments, giving high ratings to companies and governments that didn’t necessarily deserve them.

Despite these warning signs, investors continued to rely on AAA Ratings’ ratings. After all, the agency had a long history of providing accurate and trustworthy assessments.

One day, a crisis hit the financial markets. A large company that had been given a high rating by AAA Ratings suddenly defaulted on its debt.

The markets were thrown into chaos, and investors began to lose faith in AAA Ratings’ ratings. They realised the agency had been giving high ratings to companies and governments that didn’t deserve them and that its ratings were no longer reliable.

In the aftermath of the crisis, AAA Ratings was heavily criticised for its lack of quality control and its prioritisation of profits over accuracy.

The agency’s reputation was irreparably damaged. It lost much of its business to more trustworthy competitors.

Does this seem familiar?

The story of AAA Ratings is a cautionary tale about the dangers of prioritising profits over quality.

It shows that trust and reputation are essential in the financial industry, and that even the most respected institutions can fall from grace if they lose sight of these principles.

These firms assigned ratings to clients for a price. They were also engaged by their clients for other consulting services.

I mentioned the Lehman Brothers case, but this modus operandi is followed globally.

If we look at Indian markets, we have an example of Dewan Housing Finance Corporation Ltd (DHFL).

Three months before its collapse in June 2019, DHFL’s rating was “AA+” by CARE Ratings. It was changed to “D” when the company defaulted to repay its Rs 8.5 bn of outstanding Commercial Paper (CP) out of which Rs 7.5 bn was due in June 2019.

Should this stop you from investing in credit rating companies?

As a technical analyst, I’m not sure about the fundamentals and valuations of these companies, but I know that the technical structure on the charts, is telling me the bulls have the upper hand.

The constituents of the above India Credit Rating Agency Equal-Weighted Index are Crisil, ICRA, and Care Ratings.

The golden cross moving average technical pattern is visible on the weekly chart.

A golden cross is a bullish technical analysis pattern that occurs when a short-term moving average crosses above a long-term moving average.

Specifically, it refers to the 50-day moving average crossing above the 200-day moving average. This pattern is thought to signal a shift in the trend of the market or asset from bearish to bullish.

Traditionally, the 50-day and 200-day are used to define the golden cross but when it forms on the weekly chart, the primary trend is more convincing.

The sustainable move above the breakout confirms the bullish trend on the chart. This is supported by the Moving Average Convergence Divergence (MACD) oscillator.

MACD is a popular technical analysis indicator used to identify changes in the momentum, direction, and strength of a particular asset or market.

The bullish crossover of an average, above the integer or zero line, signals the strength in the momentum of the bullish trend.

I’m not a believer in valuations and growth stories but the technical setup is offering low-risk entry point in this sector.

A bit about fundamentals

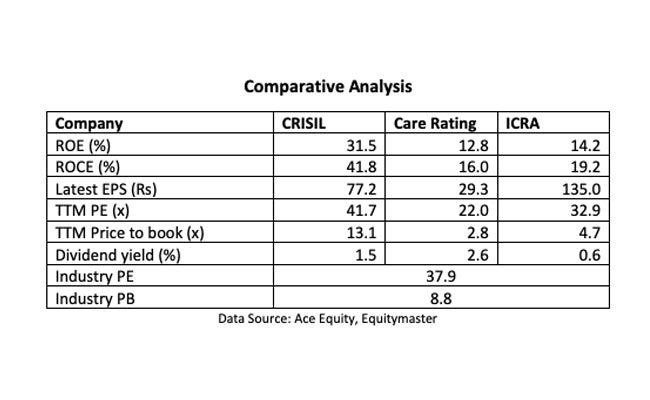

Let’s take a look at the top rating agency stocks in India and how they compare against each other.

#1 CRISIL

CRISIL is one of the leading rating agencies in India. It also provides research and risk advisory services.

The company’s rating services span an entire range of debt instruments of over 8,000 companies. It has a presence across the globe and draws most of its revenue from North America, India, and Europe.

CRISIL’s revenue grew at a compound annual growth rate (CAGR) of 9.6% in the last three years. The net profit has also grown at a CAGR of 10.6% during the same period.

It is among the most profitable midcap stocks in India.

Going forward, CRISIL plans to leverage its parent company’s brand (S&P Global) to expand in the international market.

#2 CARE Ratings

Established in 1993, CARE Ratings is the second largest credit ratings agency in India (in terms of share of domestic ratings). It provides credit ratings across spectrum of instruments like IPOs, debt, debentures, bank loans, etc.

Its list of clients includes banks, financial institutions, private sector companies, central public sector undertakings, sub-sovereign entities, small and medium enterprises (“SMEs”) and microfinance institutions etc.

For CARE Ratings, over 90% revenues come from ratings business. This compares to 30% contribution in case of CRISIL and 70% in case of ICRA (other segments being advisory and research).

Nor does CARE Ratings enjoy the parentage of global rating agencies like Moody’s (majority stake in ICRA) and S&P Global (majority stake in CRISIL).

#3 ICRA

ICRA was set up in 1991 by leading investment institutions, commercial banks and financial services companies as an independent and professional investment Information and Credit Rating Agency.

It is involved in rating, management consulting and outsourcing and information services etc.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com

Featured Video Of The Day

Worst Week For Markets In Over 6 Months