Investors should be wary of bearish strategists who opt for a macro view and instead focus on individual companies, CNBC’s Jim Cramer said Monday.

“You always hear about missing the forest for the trees, but when you’re picking stocks, it’s just as important not to miss the trees for the forest,” Cramer said.

In a market where idiosyncratic performers are plentiful, following one-size-fits-all macro advice can leave investors confused, Cramer says. That’s why it’s crucial that investors focus on the details of each company instead.

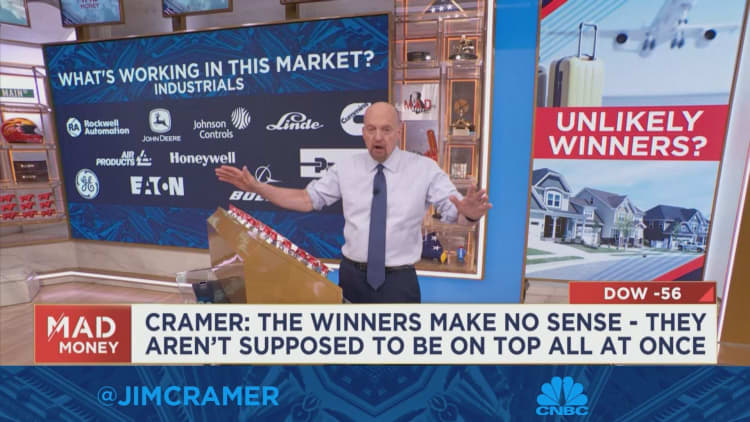

Cramer pointed to outsize performers in myriad industries that would have been written off by those same bearish strategists.

Investors might expect that industrial and homebuilding stocks would be suffering given the continued rate hikes, Cramer said. But industrial names like General Electric or Cummins have done extremely well, as have housing stalwarts like KB Home and Lennar, Cramer said.

It’s a similar story with health names like Abbott Laboratories and Medtronic, Cramer continued. Consumer names like Campbell Soup and PepsiCo “all look great right now” as well, Cramer said, to say nothing of big-cap tech names like Nvidia and Meta.

“Individually, you can make a case for any of these groups,” Cramer said, “but collectively, the mosaic doesn’t seem to make any sense.” That’s why it’s so crucial to get deeply familiar with a company before making an investment in it, and why investors can’t rely on broader macro strategists to make assessments about individual stocks, he said.